Lessons I Learned From Info About What Is The Logic Behind Trend Lines X And Y Chart Excel

:max_bytes(150000):strip_icc()/dotdash_final_The_Utility_Of_Trendlines_Dec_2020-01-1af756d4fd634df78d1ea4479d6af76c.jpg)

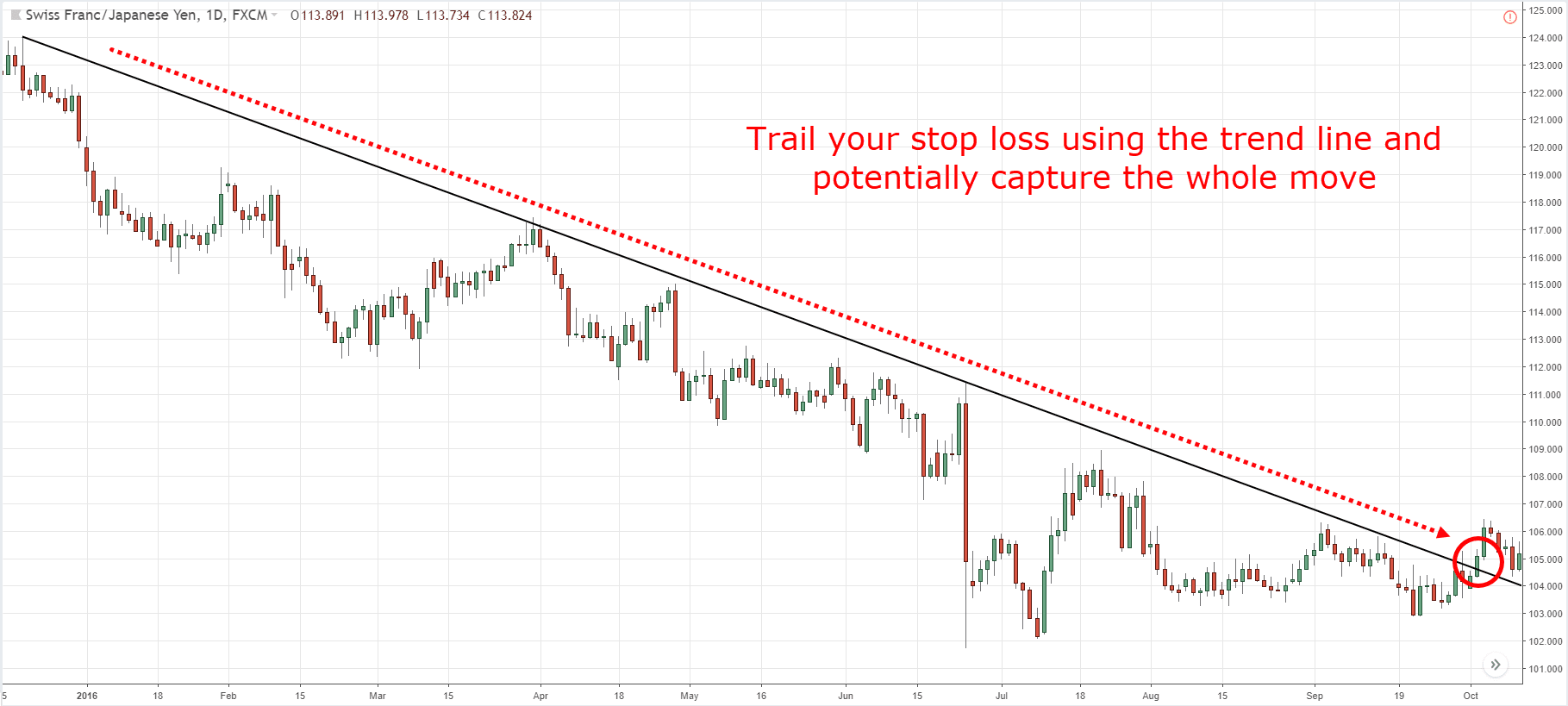

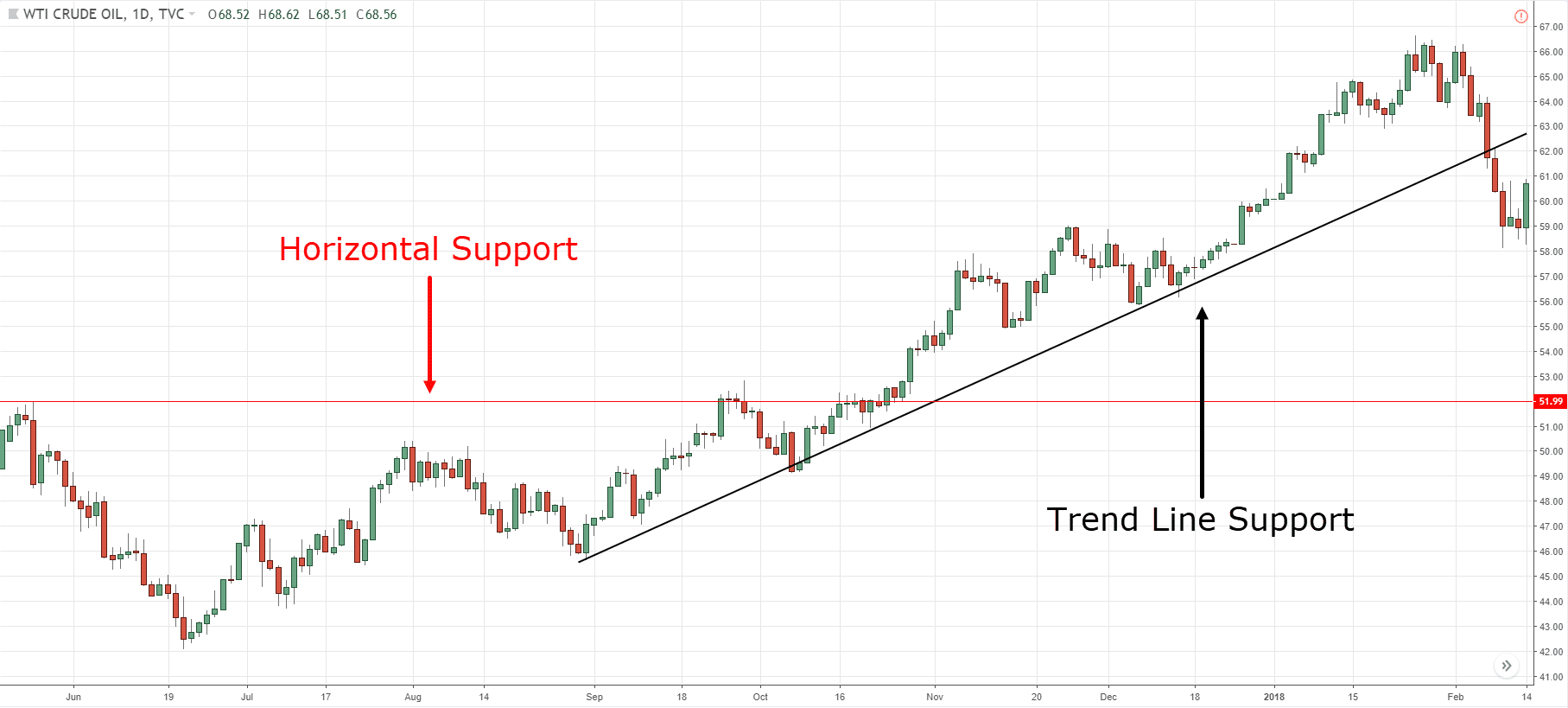

A trend line is a line on a chart that connects many price points, showing the way the market moves.

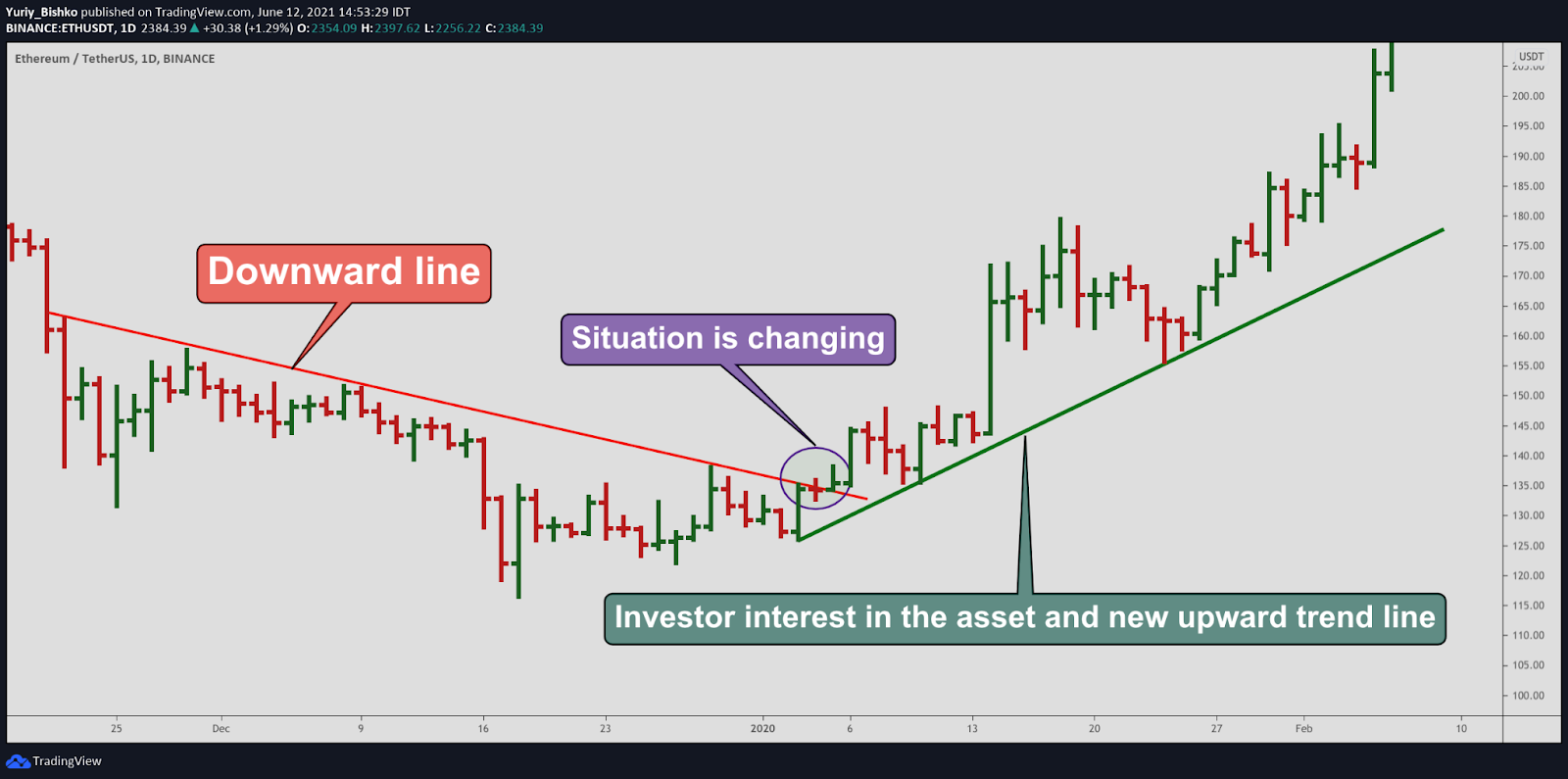

What is the logic behind trend lines. The slope of the trendline shows the direction of the trend: A few pointers on what not to do when learning how to use trend lines. Trend lines are diagonal lines drawn through a chart, highlighting a price range or trend.

Supply and demand of the instrument in question drives the market price. The five different types of trend lines are: Its elegance comes from its simplicity:

A trend line is a straight line that connects two or more price points, indicating the direction of the overall trend. In my opinion, therefore, they should be called supply and demand lines because this more accurately reflects the logic behind them. In this blog post, we’ll explore trendlines, how to draw them, and what they can tell you about market trends.

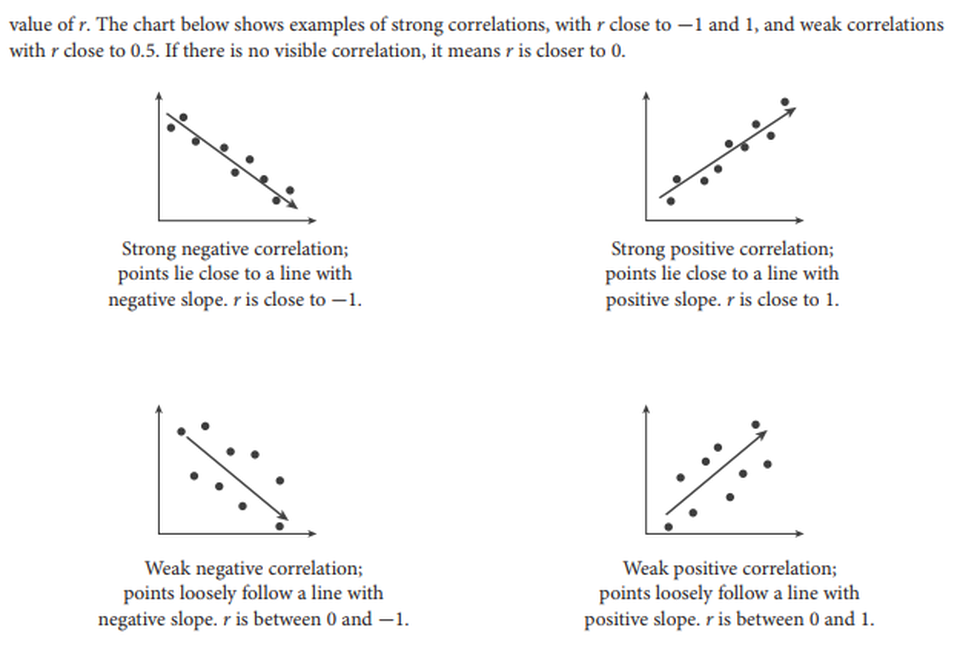

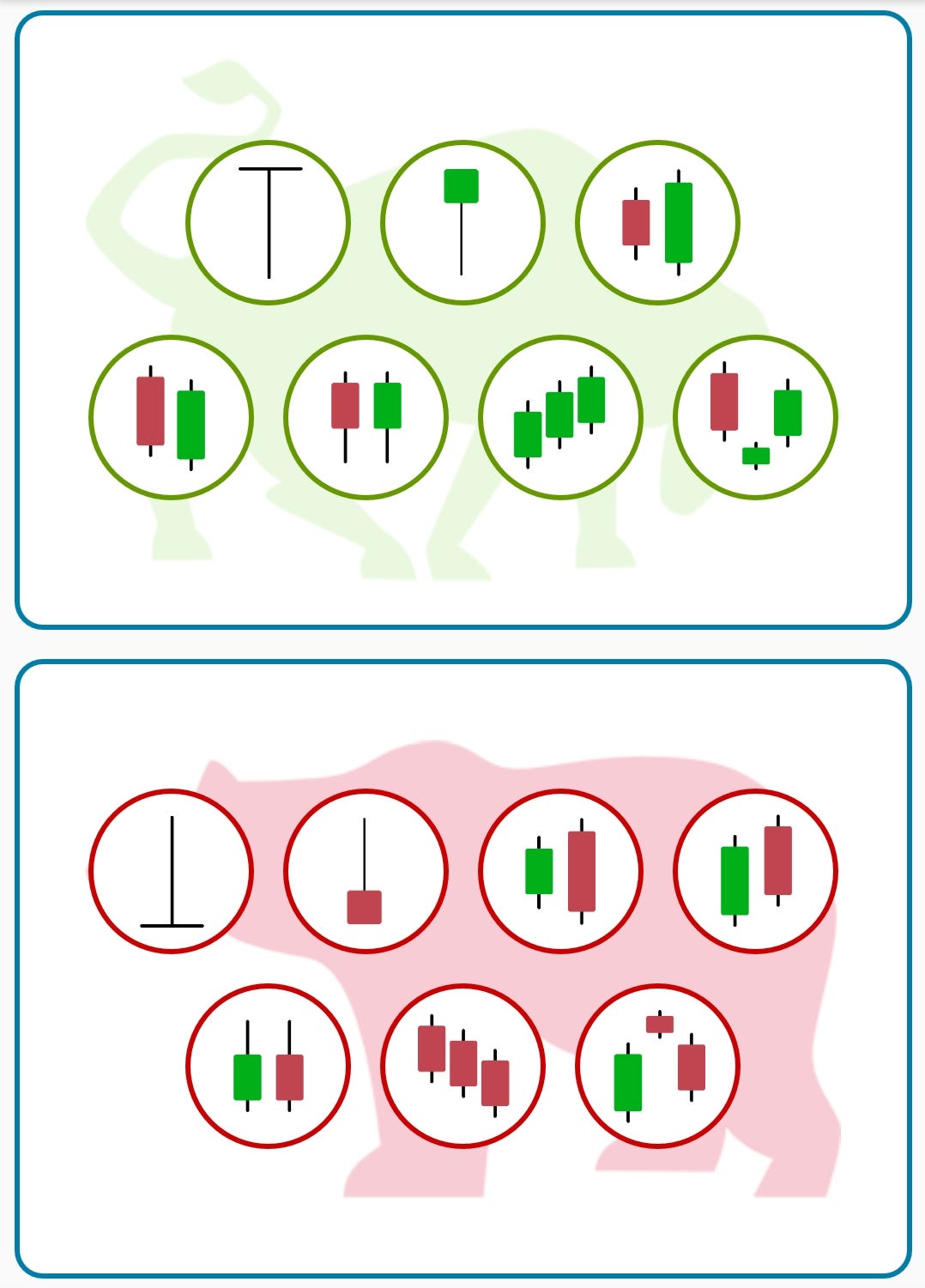

Trendlines are used to determine whether an asset is in a form of uptrend or downtrend. Technical analysts use support and resistance levels to identify price points on a chart where the probabilities favor a pause, or reversal, of a prevailing trend. I will try to explain the differences and when to use them.

In more basic terms, trend lines involve connecting a series of prices on a chart to reveal the general direction of stock price movements. It represents the direction and slope of the market trend, whether it is moving up, down, or sideways. A trend line is a straight line drawn on a price chart that connects two or more significant price points.

Trendlines are a simple yet powerful technical analysis tool that can help you identify patterns in price movements and make informed decisions about when to buy or sell. Trend lines are used to visualize the overall trend and provide a framework for understanding price action. Trendlines are easily recognizable lines that traders draw on charts to connect a series of prices together.

This tool is very important in technical analysis because it helps traders see trends fast. These lines follow a financial asset’s price movement to show traders how high or low the price may move in a particular duration. What a trend line is, and how (and why) it works across most markets.

Hear from a fidelity technical research associate about trendlines, how to identify them, and step through an example on a price chart. Trend lines are straight lines that connect two or more price points on a chart to identify and confirm trends. It is used to identify support and resistance levels and to help traders make buy or sell decisions.

This is common practice when using statistical techniques to understand and forecast data (e.g. Just trace the line and either follow the trend or wait for a breakout. Trendlines are a visual representation of support and resistance in any time frame.

The support price is a price at which. They also provide insights into whether an asset is a buy or sell at a specific price, and whether a trader should choose to. The support and resistance (s&r) are specific price points on a chart expected to attract the maximum amount of either buying or selling.