Neat Info About What Is Arima And Lstm Across The X Axis

In this content, we will compare two popular and powerful models for time series prediction:

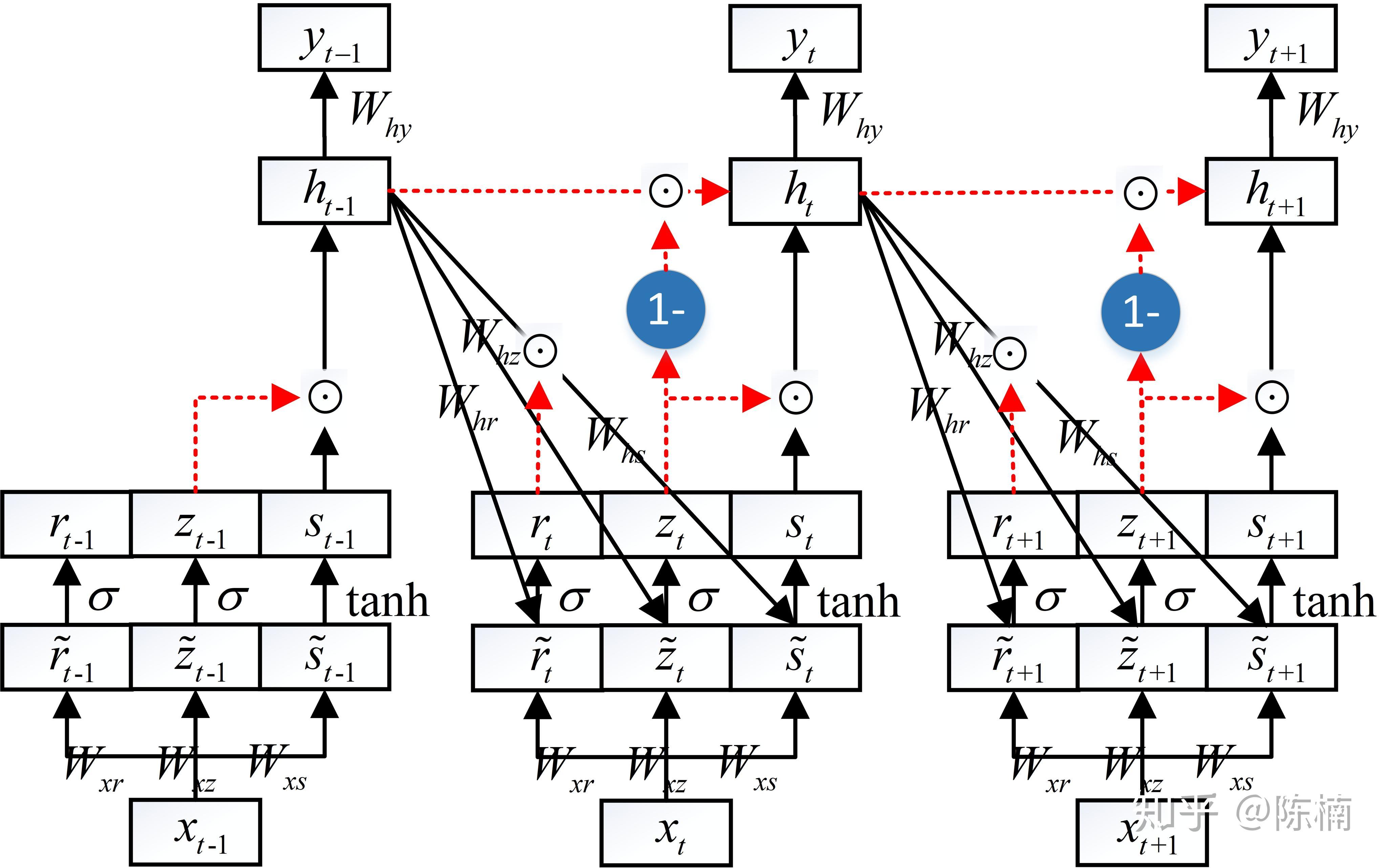

What is arima and lstm. It is a model or. Time series forecasting is an indispensable tool in various sectors, including finance, economics, meteorology, and. While arima relies on the relationships between lagged values of a time series, lstm is an artificial neural network that recognizes patterns in sequences of.

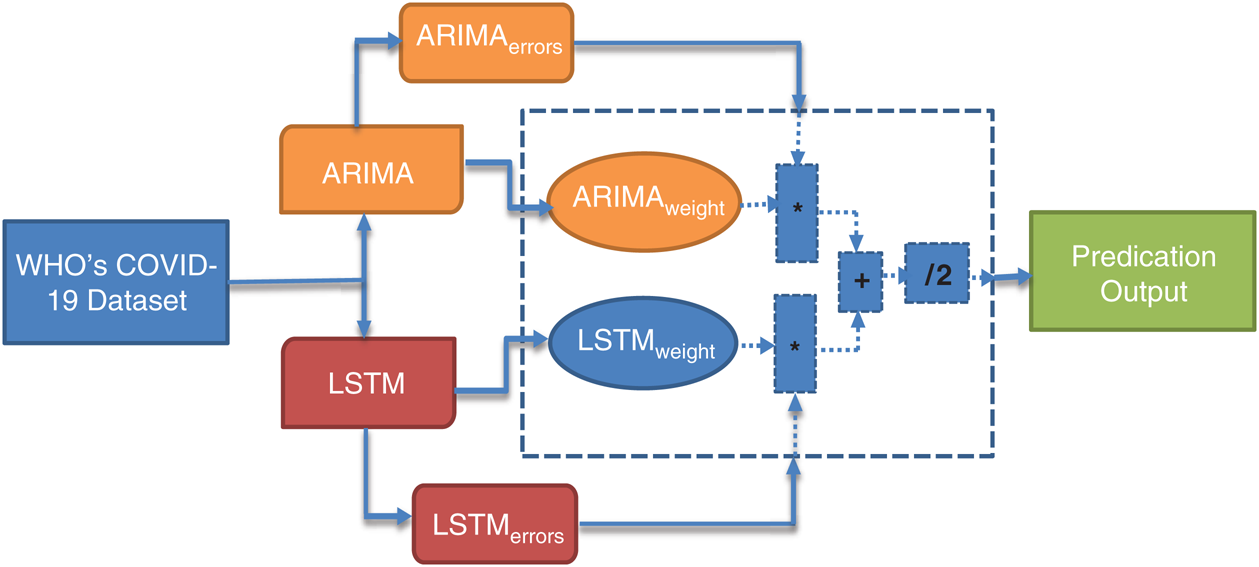

Arima model is a class of linear models that utilizes historical values to forecast future values. Autoregressive integrated moving average (arima) lstm neural network. Soumik ray a 1 2.

Arima models are linear and lstm models are nonlinear. The present work discusses about prediction of item inventory stock using four prominent time series forecasting models. The purpose of this article is to provide.

A critical area of machine learning is time series forecasting, as various forecasting problems contain a time component. These models offer distinct strategies. Understanding problems and scenarios where arima can be used vs lstm and the pros and cons behind adopting one against the other.

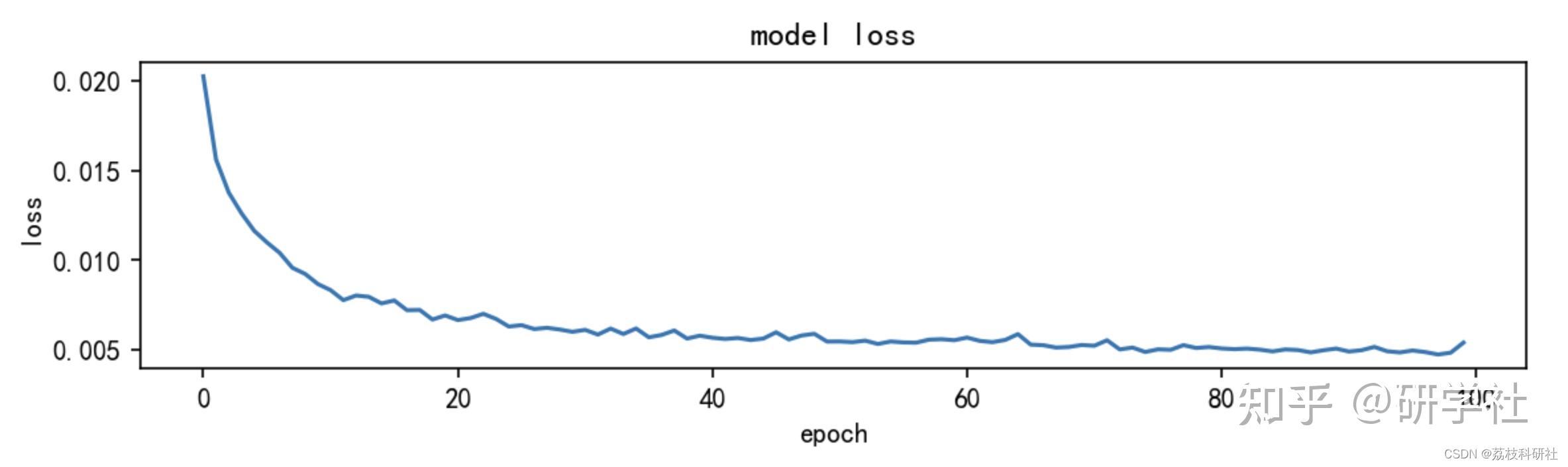

A widely recognized linear time series prediction method is arima (autoregressive integrated moving average). What is arima. The study shows that lstm outperforms arima.

What is the arma arima lstm? The empirical results show that lstm and svr nonlinear models can yield slightly better performance accuracy than the linear model arima on average for log closing price series (37 trading days). Arima stands for autoregressive integrated.

A series of observations taken. Some other parametric nonlinear time series models that statisticians have studied are threshold. Author links open overlay panel.

This research concluded that lstm is more accurate than arima (rmse of arima 0.144887 to lstm 0.051828) in a shorter dataset of 36 data points and this result is. Traditionally, there are several techniques to effectively forecast the next lag of time series data such as univariate autoregressive (ar), univariate moving average. Using lstm and arima models for stock forecasting.

![[PDF] Forecasting Economics and Financial Time Series ARIMA vs. LSTM](https://d3i71xaburhd42.cloudfront.net/75e895086f91a1a212a01dd8f426e535db01979f/17-Figure2-1.png)

-2.png)

![[PDF] Web Traffic Time Series Forecasting using ARIMA and LSTM RNN](https://d3i71xaburhd42.cloudfront.net/2444c9ea09e984ff72ca346a896dab68490fea06/3-Figure1-1.png)