Who Else Wants Tips About How Do You Smooth Data With Moving Averages Synchronize Axis Tableau

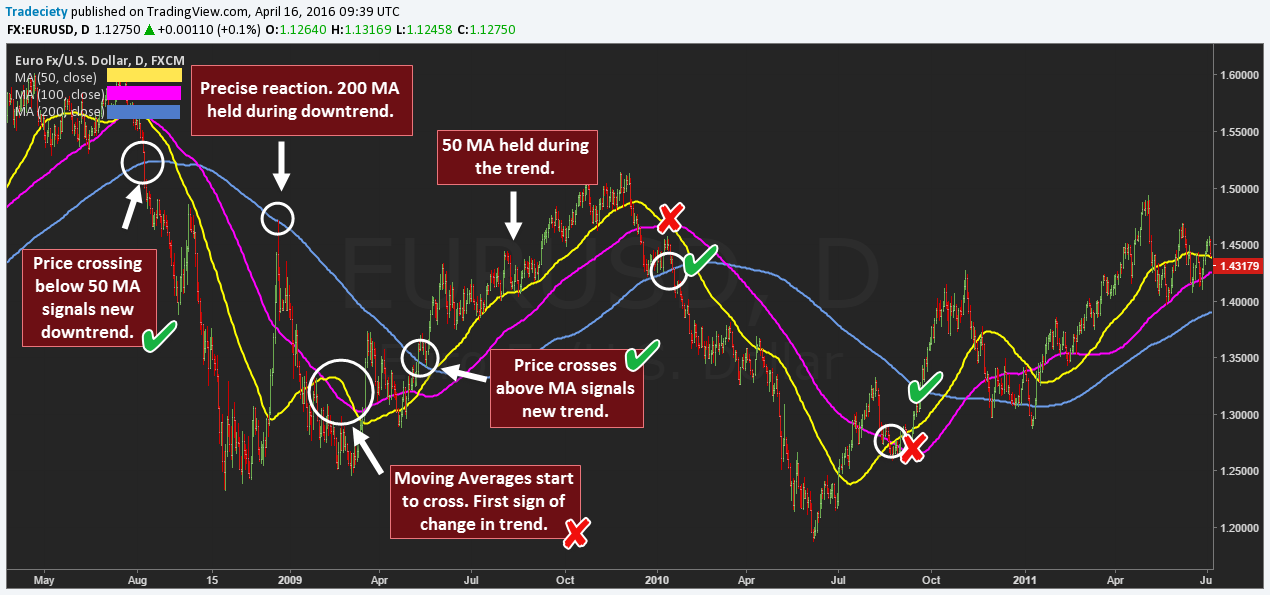

Traders use moving averages to.

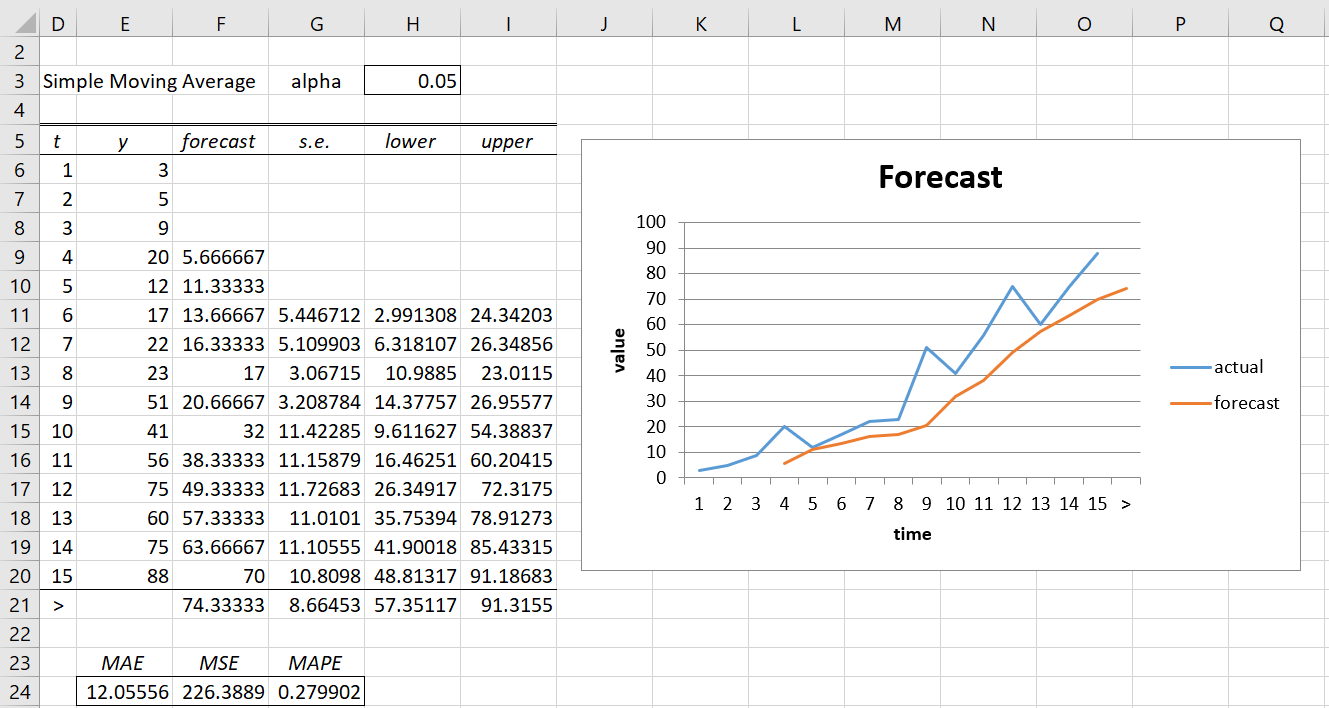

How do you smooth data with moving averages. However, don't smooth the data so much that you lose important details. Smoothing is the process of removing random variations that appear as coarseness in a plot of raw time series data. One method of establishing the underlying trend (smoothing out peaks and troughs) in a set of data is using the moving averages technique.

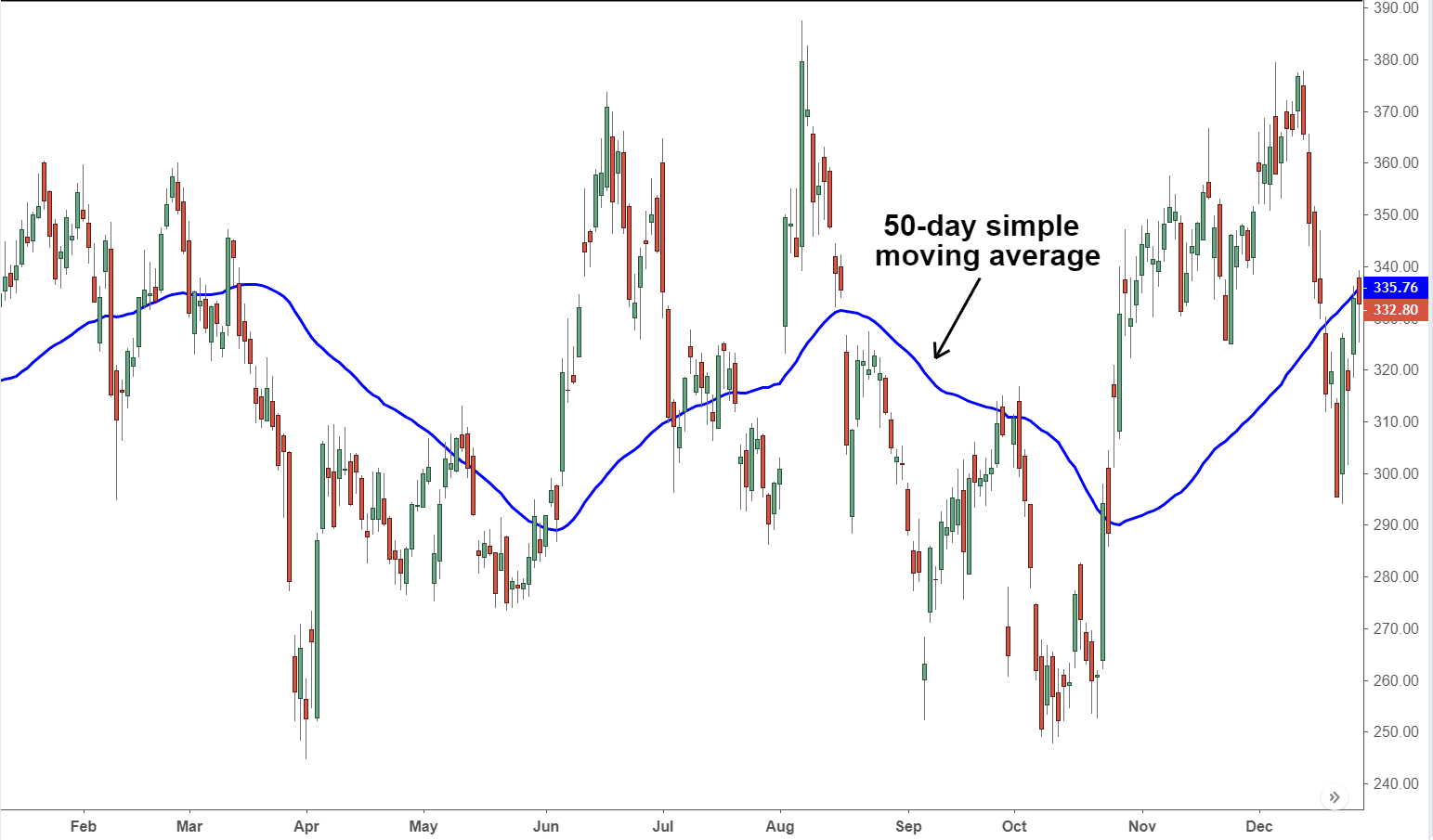

Those spans of time could be relatively short. They smooth out price data, making it easier to spot trends. Smoothing for visualization:

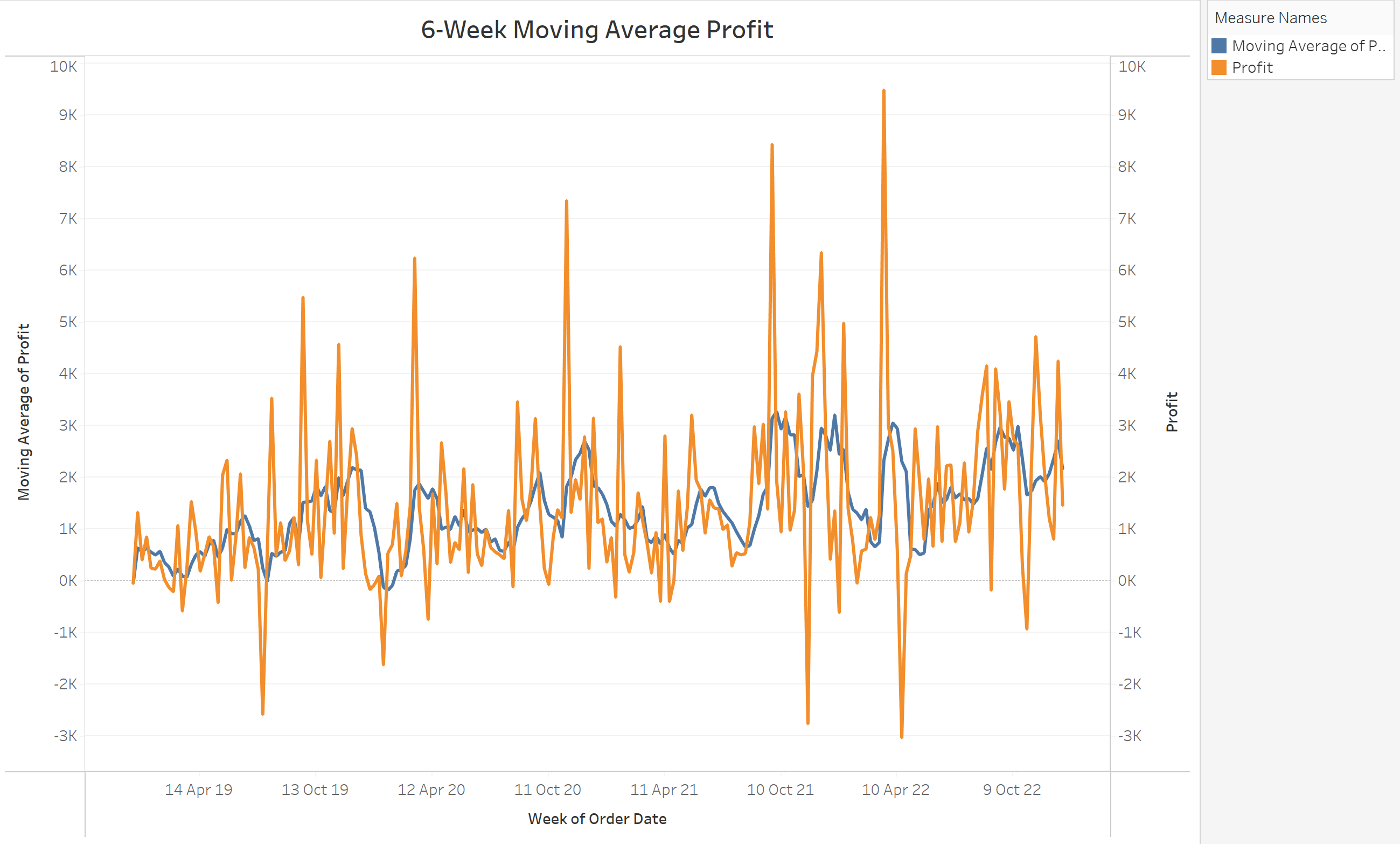

In this tutorial, you will discover how to use moving average smoothing for time series forecasting with python. Time series analysis and forecasting are important concepts in data science that have a variety of applications. Identifying market trends with moving averages.

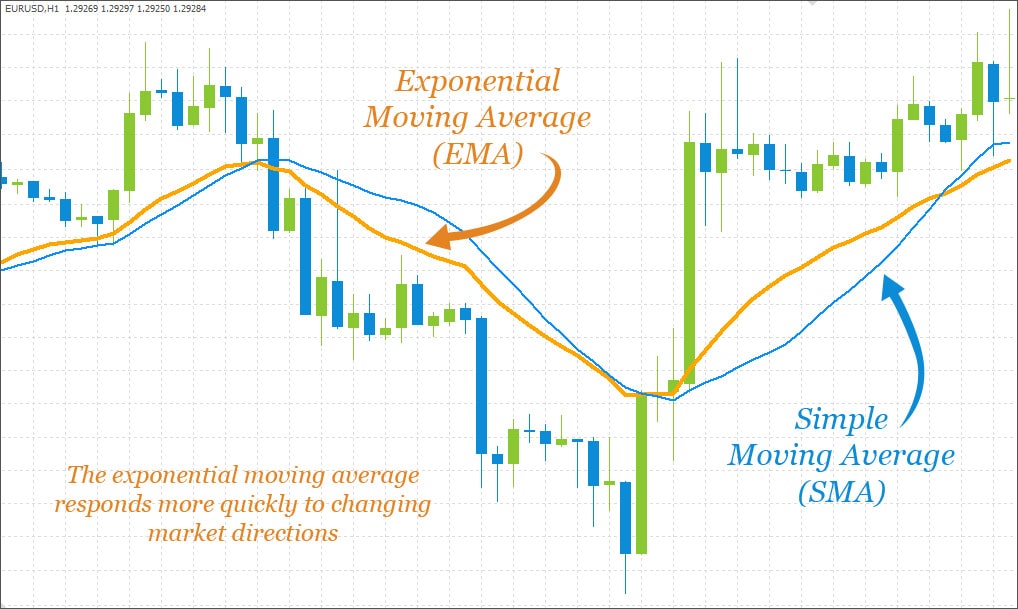

Moving averages are essential tools for forex traders. Forms of exponential smoothing extend the analysis to model data with trends and seasonal components. Higher values produce a smoother line.

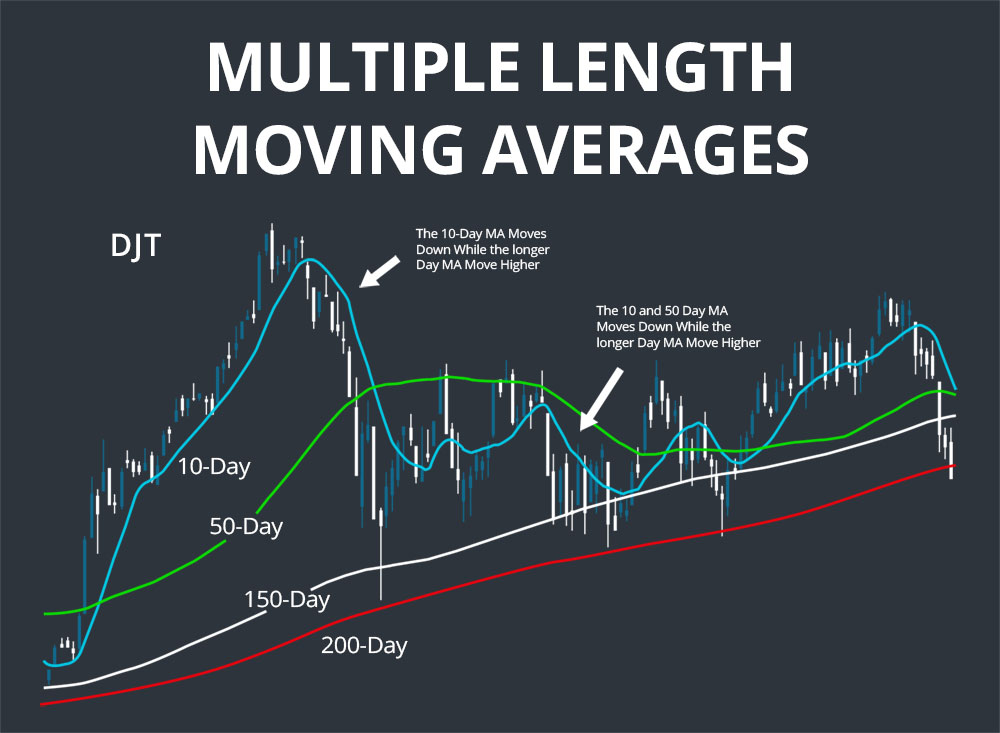

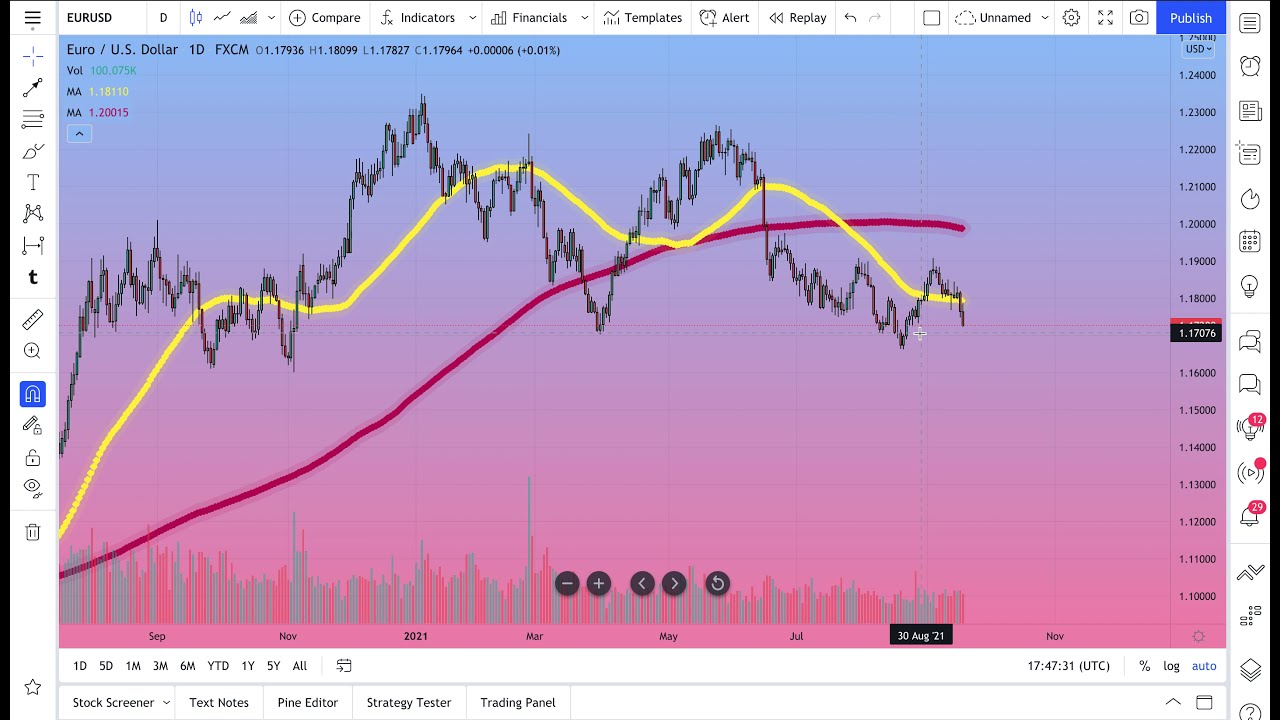

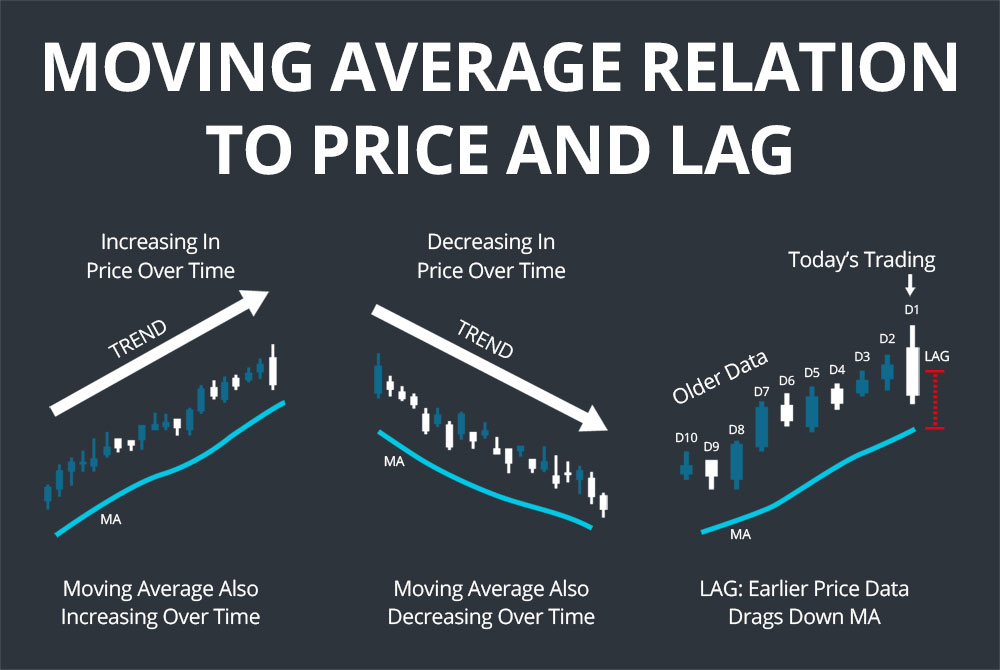

By smoothing out price data over a specific period, moving averages help traders identify trends, gauge market sentiment, and make informed trading decisions. These averages can be primarily categorized into two types: Individual poll results are shown as circles for each candidate.

If you’re interested in such methods be sure to check out moving averages, exponential smoothers, and kalman filters. Polls with greater weight in the average have larger circles. A moving average smoothes a series by consolidating the monthly data points into longer units of time—namely an average of several months’ data.

There are two distinct groups of smoothing methods. Lower values produce a less smooth line. Simple moving averages (sma) and exponential moving averages (ema).

Usually, you should smooth the data enough to reduce the noise (irregular fluctuations) so that the pattern is more apparent. It is used to identify trend direction, define potential support and resistance levels, and serves as a building block for many other technical indicators. Published on may 14, 2022.

In this article, we will delve into the concept of moving averages, explore their types, and discuss how to effectively utilize them in your trading strategies. A moving average helps to smooth price action and filter out noise in the data. Go to the insert tab.

It can be used for data preparation, feature engineering, and even directly for making predictions. A moving average (ma) is a stock indicator commonly used in technical analysis, used to help smooth out price data by creating a constantly updated average price. Moving averages and exponential smoothing in time series analysis.