Outstanding Tips About Can You Use Ols For Time Series Data How To Make Double Line Graph In Excel

Issues using ols with time series data.

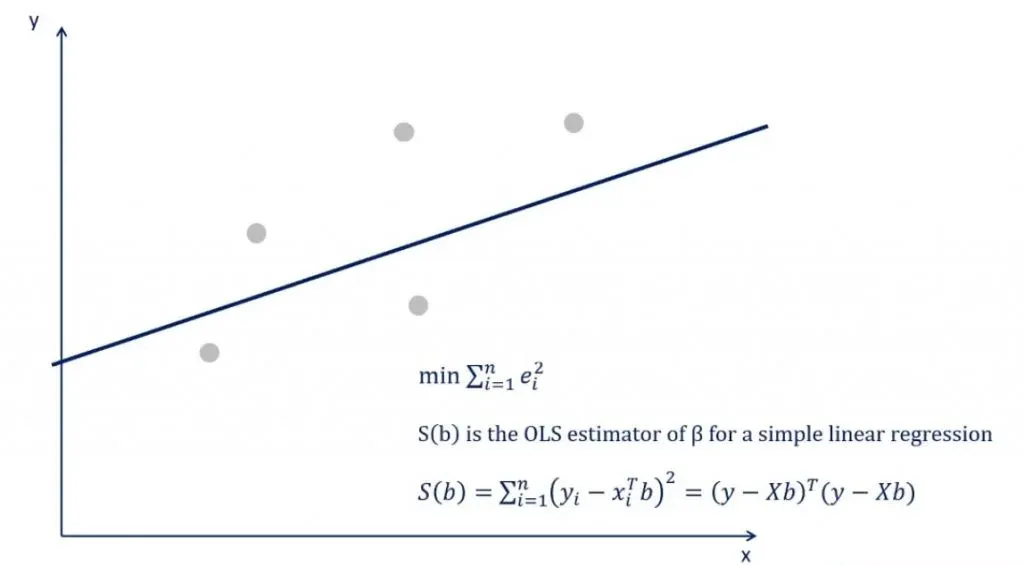

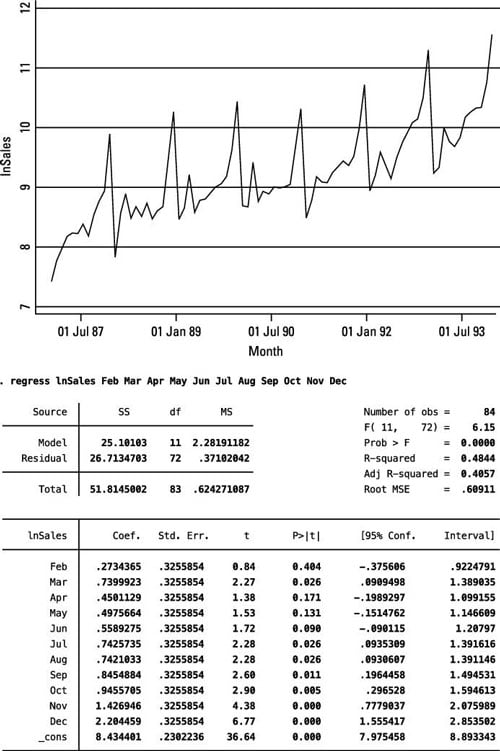

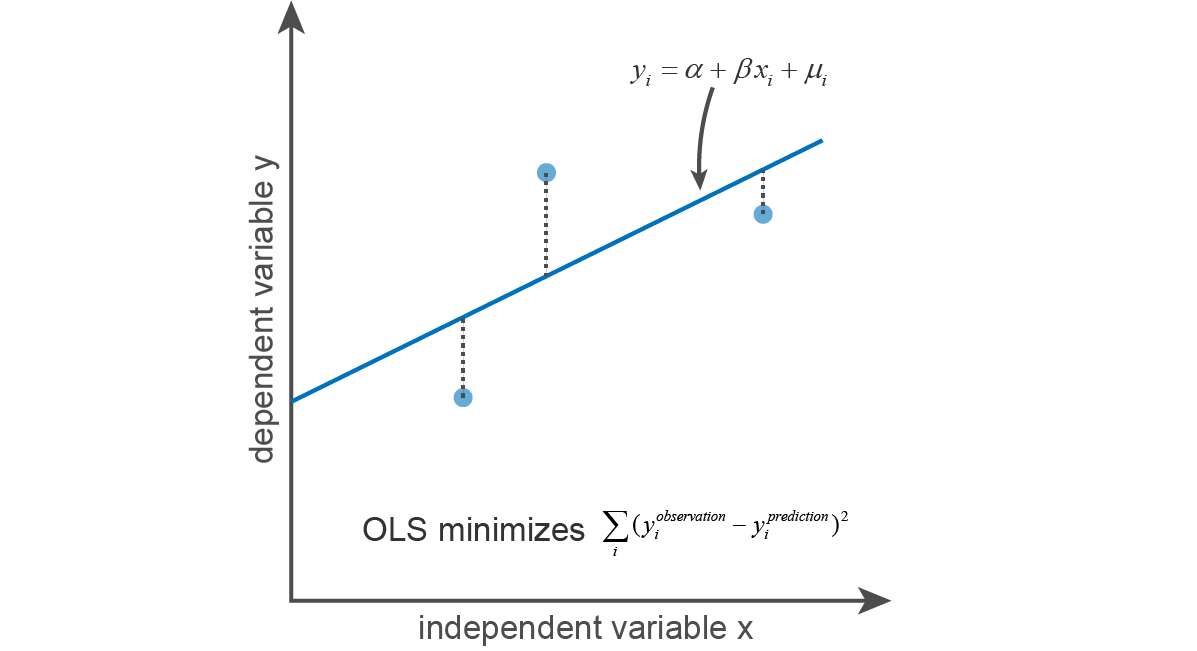

Can you use ols for time series data. But since this causes the length of the. If we run a simple linear ols regression we should be able to quickly check the association — if there is any — between the two variables: How should we think about randomness in time series data?

If lagged dependent variables are included as regressors ols is biased and is not blue (the gauss markov. The short answer to whether it is possible to use linear regression for time series data is yes, it is technically possible to use linear regression for time series data. Traffic_violation = f (speed_camera) however, remember that this is no ordinary dataset, it’s a panel data.

But the problem is we can’t apply linear regression directly on a time series data like stock price. In some circumstances it can make sense to do a form of ols, but it depends on what time series model you mean, and ols estimating which model in. Further issues in using ols with time series data.

There are time series models (such as var, arima, etc.) and there are estimation techniques (such as ols, maximum likelihood (ml), etc.). Provides a check list of conditions that. As time series data may possess.

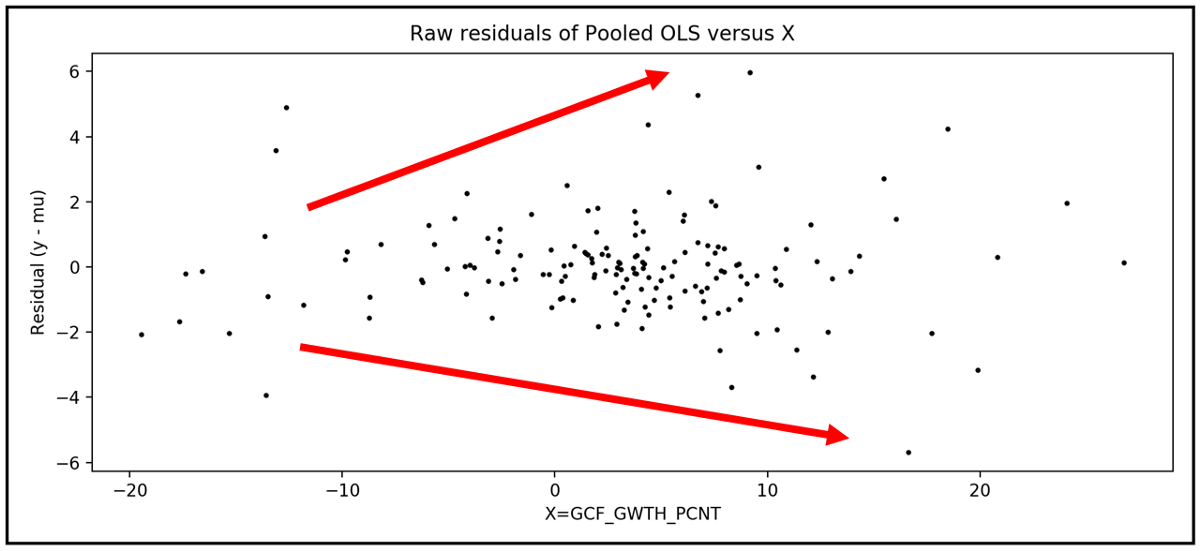

This article is the second of a three. Different models can be estimated by different techniques (sometimes more than one). In this chapter, we’ll get to know about panel data datasets, and we’ll learn how to build and train a pooled ols regression model for a real world panel data set using statsmodels and python.

Recall main points from chapter 10: Economists face method selection problem while working with time series data. When you use ols, you essentially fit a plane to this data.

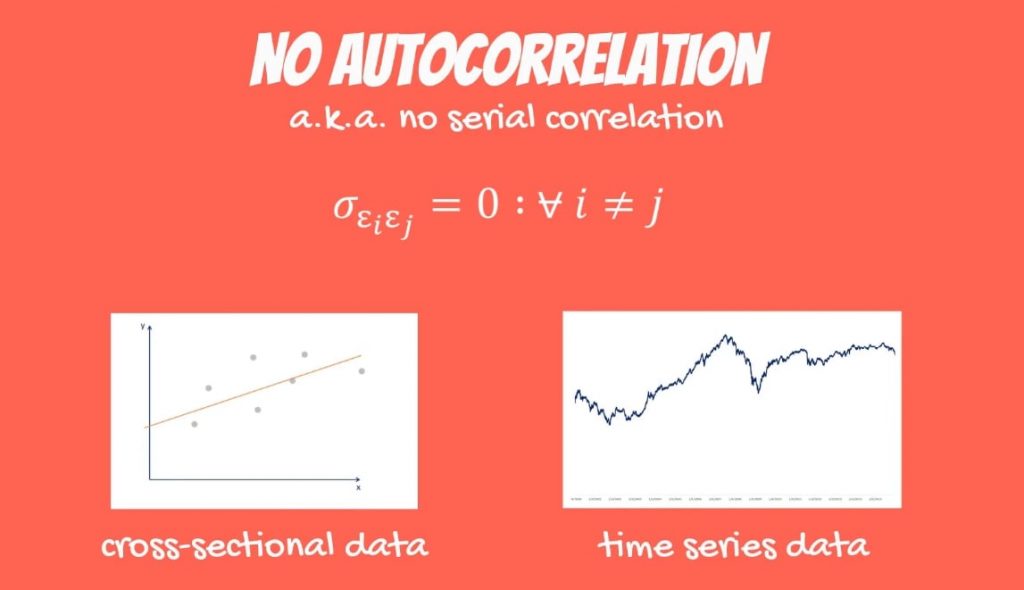

This independence property does no longer hold with time series data, and this is the basic reason why regression with time series data requires special attention when applying. We’ll perform exploratory data analysis (eda) on the bicyclist counts data set so as to judge the suitability of ols and see if any data transformations are needed. The papers talk about how they have used the data of dozens of stocks over many years to do ols and they propose to use those parameters for prediction of.

Time series data not randomly sampled in same way as cross sectional—each obs not i.i.d. By selecting an appropriate time series model based on your use case, you can gain insights, make accurate predictions, and make informed decisions based on.